Tyson Foods shares refer to securities from the food sector in the stock market. This asset is considered a promising option for investors who are interested in cheaper stocks while waiting for a recession. Before you start investing, take a look at the corporation's financials and analysts' forecasts.

Tyson Foods is a U.S.-based multinational corporation specializing in poultry, beef, and pork. The company was founded in 1935 by John W. Tyson. Since then, it has grown into one of the largest food producers in the world.

The corporation went public in 1963. During IPO, 100,000 common shares of Tyson Foods were sold at $10.50 a share. At the time of going public, the meat products manufacturer had the name Tyson Feed and Hatchery, Inc. In 1986, the company was renamed and received the now-known name. Shares of Tyson Foods are now traded on the New York Stock Exchange under the ticker NYSE: TSN.

Tyson Foods is one of the largest food producers in the United States, with a wide range of products including chicken, beef, pork, and prepared foods. The company is firmly committed to sustainability and animal welfare and is one of the leading producers of organic and antibiotic-free chicken. In addition to meat products, Tyson Foods also produces a wide variety of food products such as frozen meals, snacks,s and pasta.

The company is headquartered in Arkansas, with operations in more than 40 states. The corporation owns several brands: Jimmy Dean, Hillshire Farm, Sara Lee, Ball Park, Wright Brand, Aidells, and State Fair. Tyson Foods supplies major food service companies including KFC, McDonald's, Burger King, Wendy's, Walmart, and Kroger.

The Tyson Foods stock price was down more than 25 percent since April 2022. On Sept. 18, quotes fell to $70 from their April peaks of $95. This is due to supply chain disruptions, logistical problems, and general tension in the stock market. This situation is pushing investors to sell Tyson Foods stock.

In the second half of 2022, the global meat products market is experiencing strong price growth. This allows Tyson Foods to increase revenues. However, at the same time, the volume of delivered products during the second quarter decreased by 1.9% year-on-year. Corporate executives attributed this to labor constraints at production facilities. This prevented the corporation from producing enough products during the quarter.

In the second quarter of 2022, the corporation reported revenue of $13.5 billion. In comparison, for the same period last year, Tyson had $12.48 billion. On the negative side for investors, Tyson also had a free cash flow of $2.2 billion for the past year. The product price-to-earnings ratio was 13, which is below the market average.

Tyson Foods' adjusted earnings per share (EPS) for the second quarter of 2022 was $1.94, down from the previously projected $1.98. News that the figure fell short of analysts' expectations led to a short-lived drop in quotations. Within three months, adjusted EPS fell 28%. The company's management notes that this is due to higher raw materials and labor costs.

In making our TSN stock price forecast for the coming years, we considered the corporation's financial performance and the October 12, 2022 stock price ($64). In 2023, the stock price may be impacted by a challenging global economic environment and rising inflation. Our analysts estimate that TSN stock will trade at $59 to $66. According to the long-term forecast, the value of the food producer's securities could exceed $100 in 2025. Analysts and many investors argue that Tyson Foods stock can be considered a promising asset now, which could bring good returns in the future.

To authorize on the website and create a personal account, fill out the form, indicating your name, phone number, email address.

After registration, provide an identity document to verify your age and place of residence.

To start trading real money, the initial deposit can be made in any available way.

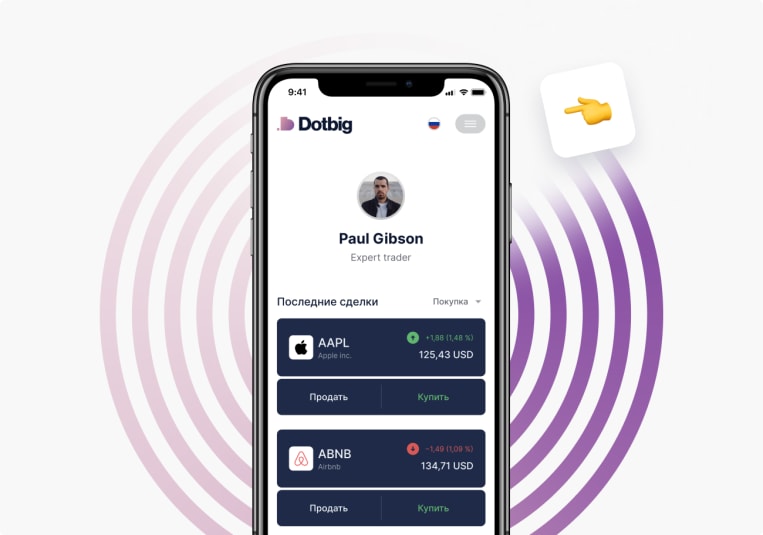

You can open/close deals on your own under the guidance of an experienced analyst or copy them from other traders.

No trading experience? Not a problem! With social trading, you can copy the trades of the best DotBig traders. Follow the rating and make a profit.

Start trading